Hengdian Group Capital joins Solu Therapeutics USD 41 million Series A financing in developing novel cell depletion agents

Hengdian Group Capital (HgC) recently completed a Series A investment in Boston-based Solu Therapeutics, a biotechnology company developing therapies to eliminate disease-driving cells in cancer, immunology and other therapeutic areas.

The round raised $41 million and included funding from new investors HgC, Eli Lilly and Company, Biovision Ventures, Pappas Capital and The Leukemia & Lymphoma Society Therapy Acceleration Program®, along with continued support from existing Solu Therapeutics investors including DCVC Bio, Longwood Fund and Astellas Venture Management.

HgC’s participation in the investment underscores its commitment to the global innovative drug sector, as well as support for Solu Therapeutics’ work in targeting areas of high unmet medical need for patients.

Proceeds from this Series A financing will be put towards enhancing Solu Therapeutics’ lead CCR2-CyTAC program, a platform used in the treatment of CMML (chronic myelomonocytic leukemia).

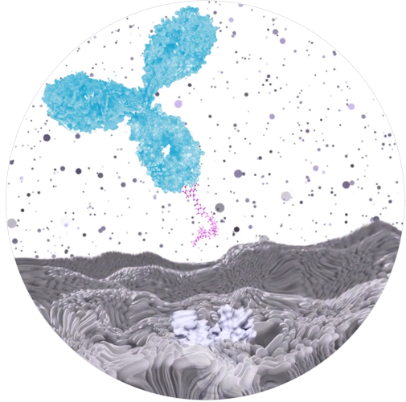

Solu’s proprietary platforms, CyTAC (Cytotoxicity Targeting Chimera) and TicTAC (Therapeutic Index Control Targeting Chimera), offer the potential for more targeted and effective treatment, said Solu Therapeutics President and CEO Philip J. Vickers.

“These technologies have demonstrated an unprecedented ability to unlock high-value cell surface targets that are beyond the reach of traditional antibodies,” Vickers explained, “making it possible to eliminate disease-driving cells with greater precision and efficacy.”

The Series A funding will also support the generation of new development candidates, including cell depletion drugs in oncology and immunology, which HgC hopes will accelerate effective, safe, and accessible treatment options for patients worldwide.

HgC’s investment will also contribute to Solu Therapeutics’ initiation of new discovery programs targeting pathogenic cells, further pipeline expansion, and exploration of new applications for the CyTAC and TicTAC platforms.

In recent years, HgC has steadily increased investment in innovative drug development worldwide. Its funding of Solu Therapeutics marks an important step in its internationalization strategy by expanding synergy between capital and industrial resources.

Previously, HgC also invested in US-based biotechs Corxel Pharmaceuticals and Atomwize, via Hengdian Group’s subsidiary Apeloa Pharmaceutical.

About Solu Therapeutics

Solu Therapeutics was co-founded by Longwood Fund in 2023 and is based in Boston. It is focused on developing an innovative class of therapeutic agents that uniquely pair small molecules with monoclonal antibodies to eliminate disease-driving cells in cancer, immunology, and other therapeutic areas.

On April 9, 2025, Solu announced the enrollment of the first patient in its first Phase I clinical trial, which evaluates the preliminary efficacy of STX-0712 in CMML. Based on positive experimental results, the company will open multiple centers and accelerate patient enrollment.

About Hengdian Group Capital

Established in 2017, HgC (Hengdian Group Capital) is the sole investment/corporate development arm of Hengdian Group. It employs a diverse range of investment strategies including venture capital, private equity, and mergers & acquisition, to invest across all stages of a company’s growth.

HgC is at its core a strategic investor, leveraging the Group’s diversified industrial and operational expertise to build long term partnerships with portfolio companies. Its holistic investment philosophy is designed to accelerate commercial application of innovative technologies, facilitate industrial upgrading, and contribute to the overall development of a sustainable economy.

Press Inquiries

E-mail: press@hengdian.com